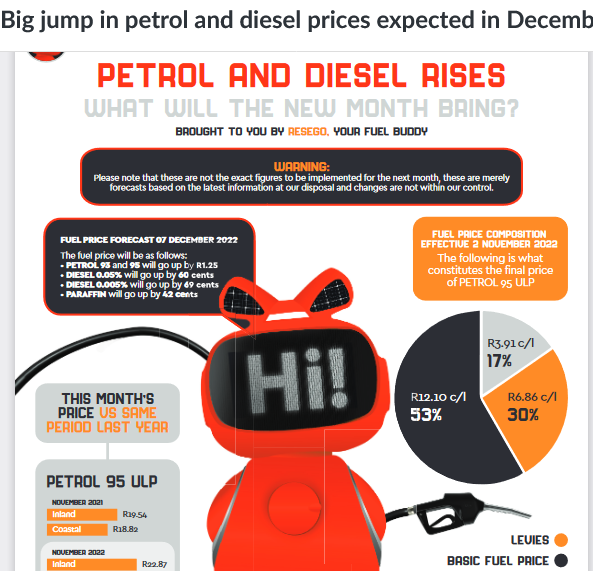

The Department of Mineral Resources and Energy has published its latest weekly fuel price forecast, showing a big hike in petrol and diesel prices expected to hit in December.

Published by the Central Energy Fund (CEF) through its digital assistant ReseGo, the weekly update provides a snapshot of market conditions at the end of each week, giving an indication of where fuel prices are headed for the coming month.

The department stresses that the snapshot is not predictive but rather serves as a fuel price indication. As market conditions change throughout the month, so too do the forecasts.

According to the forecast, the current price changes are on the cards for December 2022:

- Petrol 93 and 95: increase of R1.25 per litre

- Diesel 0.05%: increase of 60 cents per litre

- Diesel 0.005%: increase of 69 cents per litre

- Paraffin: Increase of 42 cents per litre

The CEF’s more detailed breakdown of market fluctuations shows that the key driver behind the bleak forecast is the increasing cost of international petroleum products. This is exacerbated by a weaker rand.

International petroleum prices are guided by the oil price, which has seen a sharp spike in recent days, pushing towards the $100 a barrel mark, following months persisting at $90 to $95 a barrel.

According to the Bureau for Economic Research (BER), oil prices have been buoyed by positive news out of China that it is moving towards exiting its zero-Covid strategy, which has kept oil demand muted.

“A key market mover was the positive noises from China about steps to exit its damaging zero-Covid policy by early next year,” it said.

“The former head of China’s Center for Disease Control and Prevention reportedly said that China could reopen its border with Hong Kong early next year, with international border relaxations to follow.

“This helped boost Chinese stocks listed in Hong Kong to record their best week in more than seven years. The oil price and industrial metal prices were also supported by this news, rising sharply during the week.”

Oil prices have also generally been pushed higher by growing global demand against the backdrop of tighter supply. As the northern hemisphere enters its winter months, fuel demand increases. However, this year, this is happening in conjunction with sanctions on Russia as well as a reported cut of supply from OPEC+.

This has led to a general supply crunch on fuels like diesel, with shortages being reported in the US and Europe. This, in turn, has an impact on South Africa, which is dependent on imports for its fuel supply.

November saw diesel prices shoot up by R1.60 per litre, putting the fuel at record-high prices. If the CEF’s latest forecast persists to the end of the month, this will see prices pushed even further into a new record.

The rand, which is the other important component in local pricing, has also started the month on the back foot but made some gains last week.

The local unit has been persistently weak due to the stronger dollar as well as local headwinds like continued load shedding. However, according to the BER, economic data from the US on Friday (4 November) softened the greenback, giving the rand a boost.

“In response to the more dovish comments from leading Fed officials and some mixed interpretations on the jobs data, the US dollar weakened on Friday, which helped the rand gain more than 2% against the greenback on Friday alone,” it said.

As a result, the rand strengthened to R17.99 to the dollar on Monday. If rand strength continues, any potential fuel price hikes would be smaller.

According to local economists, the rand is fundamentally undervalued and is expected to recover in the coming quarters. Economists at Absa believe the rand will strengthen further before the end of the year – to R16.75 to the dollar – while the South African Reserve Bank sees the currently at R17.38 to the dollar.